Contents:

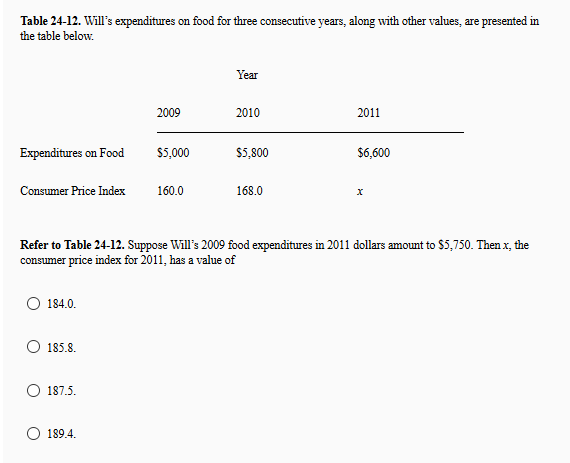

You are required to file 1099-MISC with the IRS and provide a copy to your contractors ; if you fail to do either or both, there are penalties that you may have to face. These penalties increase with time, so you must file as soon as you realize that you forgot to file your 1099-MISC. If you missed the filing deadline, you need to pay $50 per W-2 and $30 per 1099 if you file them within 30 days of February 1. If so, don’t panic—we guarantee you’re not the only one!

- In the past, you used 1099-MISC, but for 2020 payments use newForm 1099-NEC for consulting payments and any other form of independent contractor pay.

- The IRS will accept filings by the business day following the specified date if it falls on a Saturday, Sunday or legal holiday.

- Copy A of form 1099-MISC is due to the IRS on Feb. 28, or Mar. 31 if filed electronically, and due to payees by Jan. 31.

- The first is for self-employed people with highly variable income.

Submit copies of both the original and new versions of those, along with your 1040-X. If you don’t realize your mistake on time, it’s very likely you’ll receive a CP11 Notice. If you end up with a smaller refund, you can simply pay back the difference when you file your amended return. You can still report your 1099 income without having the actual 1099, so long as you know how much money your client has paid you.

Look under the Splits column for what accounts the vendor’s transactions were tied to. If you see the word “SPLIT,” select the transaction to see details on what accounts were affected. Select the arrow next to the filter icon at the top of the table and change the type of contractors to 1099 Contractors below threshold.

Failure to File Dates

Form 1099-NEC is used to report payments to non-employees who provide services to the business. These individuals include freelancers, gig workers, independent contractors, attorneys, and other professionals. Providing 1099-MISC to your contractors is equally essential as providing W-2s to your employees. Most businesses have systems in place or use third-party services for payroll processing, and they take care of the year-end W-2 filing. However, generally, there is no proper system in place for 1099-MISC filing. But remember the independent contractors that provide you services during the year need their 1099-MISC form just like employees do their W-2s.

If this is starting to sound complicated, that is because it is. Taxpayers often make mistakes by taking the wrong RMD amount, taking an RMD from the wrong account , or missing an RMD altogether. So, we’ve put together some important information to help you prepare, validate, and eFile your 1099 forms.

Calculating your estimated taxes with Form 1040-ES

NEW YORK — The deadline to file your taxes is Tuesday, which is just around the corner. Filing U.S. tax returns — especially for the first time — can seem like a daunting task, but there are steps you can take to make it less stressful. The deadline to file your taxes is Tuesday, which is just around the corner.

Your business can request a 30-day extension by submitting IRS Form 8809. The form should have been submitted by January 31, but you can still send it in. It is not guaranteed that the IRS will accept the form if submitted after the deadline. Sometimes scams are even operated by tax preparers so it’s important to ask lots of questions. If the amount of taxes you owe becomes too large, you can apply for a payment plan. After you file your 1099s to the IRS, you’ll receive a confirmation about your filings’ status through email.

Our app will automatically scan your accounts and help you deduct anything you buy for work, from gas for your car to software for your laptop. But first, let’s talk about who needs to pay them in the first place. I did not realize Turbo Tax online would shut down on or just after the 15th of Oct. There probably would not be a penalty if he was under the gross income requirement. Only include the total for the accounts that had a shortfall.

Missed a Quarterly Tax Payment? Here Are the Penalties (And How to Get Out of Them)

A 1099-MISC is an IRS information form that you must send to non-employees to whom you’ve paid at least $600 over the course of the year. All features, services, support, prices, offers, terms and conditions are subject to change without notice. To avoid an underpayment penalty, be sure to include your miscellaneous income on your Form 1040. If your income is nonemployee compensation, you’ll likely need to complete Schedule C, Profit or Loss From Business, and then transfer the net earnings to Form 1040. For rents or royalties, you will typically complete Schedule E, Supplemental Income or Loss, and then transfer the applicable amount to Form 1040.

IRS Form 1099-NEC Means Extra Taxes – Forbes

IRS Form 1099-NEC Means Extra Taxes.

Posted: Mon, 21 Nov 2022 08:00:00 GMT [source]

January 31 is also the deadline for filing W-2s with the Social Security Administration and 1099-NECs with the Internal Revenue Service . For more details on this process, see the chart on page 12 of the IRS’ General Instructions document. Prepare a new information return, entering an X in the “CORRECTED” box at the top of the form. Prepare a new transmittal Form 1096 and include it with your mailing to the IRS Submission Processing Center for your location. Prepare a new return and enter an “X” in the “CORRECTED” box at the top of the form. For due dates for other types of 1099 forms, see the chart on pages of the IRS’ General Instructions document.

Don’t File an Amended 1096

Taxpaying businesses may apply for a 30-day extension on filing a 1099 form by completing Form 8809, an Application for Extension of Time to File Information Returns. You may submit Form 8809 either electronically or on paper, and need not sign the form. However, the extension only takes effect if the business applies for it before the due date. It’s not necessary to submit an explanation to obtain the extension.

Final 2022 quarterly estimated tax payment due January 17 … – IRS

Final 2022 quarterly estimated tax payment due January 17 ….

Posted: Tue, 17 Jan 2023 08:00:00 GMT [source]

Once you discover your https://1investing.in/ and realize you have an additional 1099 to file after filing the 1096 form, simply fill out the 1099 form you missed the first time around. Input the information just as you would if you’d done this originally. The IRS penalizes companies for not filing 1099s by the due date and for filing incorrect 1099s. Businesses must issue all 1099s including 1099-MISC forms by January 31 after the end of the calendar year. Form 1099-C is the lone exception, and businesses must issue these forms by February 15.

You can also mail 1099 forms to the IRS directly, or you can use one of the IRS-approved private delivery services. See page 7 of the IRS’ General Instructions document for a list of current mailing addresses. If you are mailing 1099 forms to the IRS, you must include a transmission form, Form 1096; you don’t need this form if you are filing electronically. You can mail corrections on paper forms if you originally filed them by mail.

- Proceed through the screens like you’re re-submitting all the 1099s and click the payment you want.

- Instead, this box now contains a checkbox to indicate $5,000 or more paid for direct sales.

- Additionally, if you have a business that uses PayPal or Venmo as a service, it must be reported in your tax return.

- They can also impose penalties for filing the forms incorrectly or incompletely.

- The IRS deadlines for forms 1099-NEC and 1099-MISC are fast approaching.

- There may be processing charges for some types of payments.

GO TO browsing history and look up the last place you were on Turbo tax to pick up where you left off. IT WORKS providing you did not DELETE your browsing history. Our experts review your unique situation and recommend proven tax strategies to lower your tax bill.

The IRS has procedures for filing corrected paper returns or returns filed electronically. Two common types of 1099 forms are 1099-NEC to report payments to non-employees, and 1099-MISC to report payments for rents, royalties, and other miscellaneous payments. The late filing penalty is $50 per form if you file within the 30 days of the due date. If you file after 30 days, but before August 1 of the filing year, the penalty is $110 per form.

Wait that long to file, and you’re looking at a penalty of $270 per form. The second tier of penalties kicks in if you’re at least 31 days late, but you get the forms in before August. While she’s not hiking in the Smoky Mountains or checking out new breweries (@travelingcpachick), she’s working on growing her own financial services firm. Kristin is an advocate and affiliate partner for Keeper Tax.

Once you have the right innet termsation, you can e-file your 1099 using services like Track1099 or Tax1099. Different types of 1099 penalties won’t stack — you’ll only have to pay the highest penalty you’re assessed on a single form. Waiting till fall to send all five 1099 forms to both the IRS and your recipient gets you a penalty of $2,700. In our online seller example, waiting a couple of months to file your recipient and IRS copies gives you a total penalty of $1,100. Unfortunately, not filing a required 1099 can cost you real money — especially if you don’t get things under control in time.

Gathering the 1099 and W-2 information months in advance so that you are not scrambling at the last minute to meet the deadline. If you can show a reasonable cause for your failure to fail on time, the IRS may accept the excuse and waive the penalty. Your 1099s and W-2s should have been e-filed on postmarked by January 31. In aprevious episode, I explained the who, what and how to file 1099-NECs for your business. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.